【C#】 25. 根据Option组成的投资组合的payoff,识别组成成分

栏目:php教程时间:2015-06-01 08:29:27

今天终究做了1个很久之前就想完成的option利用!

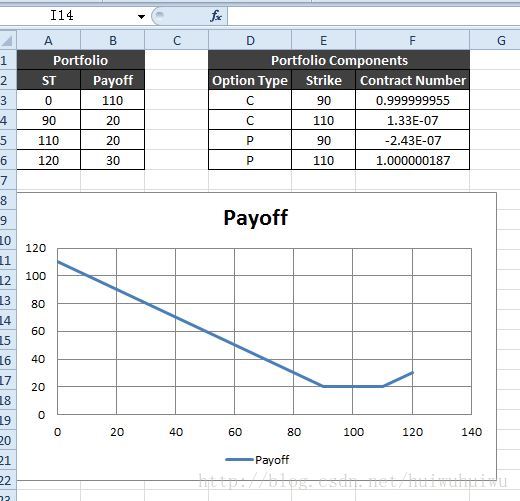

假定现在有1个全部由Option构成的投资组合,这些option的underlying都是同1个股票,有相同的maturity。

在Excel中写个函数,它可以根据portfolio在不同underlying price时的Payoff来辨认投资组合中各个option组成。

上图左侧的表格就是Input,Payoff图在其下方(strangle);而右侧的表格就是计算得到的结果,我写的这个函数名字为 OpTypeStrikeContractNum 。

using System;

using System.Collections.Generic;

using System.Linq;

using System.Text;

using ExcelDna.Integration;

using FinMktReverseEngineering;

using Excel = Microsoft.Office.Interop.Excel;

using System.Runtime.InteropServices;

using Microsoft.SolverFoundation.Services;

using Microsoft.SolverFoundation.Solvers;

namespace OptionFunctions

{

//Solver Class for calculate the contract number for options

public class CSolver

{

private double[] interpolatedStockPrice;

private double[] interpolatedTargetPayoffs;

private Option[] options;

private int optionNum;

//Constructor

public CSolver(Option[] Options,double[] InterpolatedTargetPayoffs, double[] InterpolatedStockPrice)

{

this.options = Options;

this.interpolatedTargetPayoffs = InterpolatedTargetPayoffs;

this.interpolatedStockPrice = InterpolatedStockPrice;

this.optionNum = options.Length;

}

//Target Function

public double TargetFunction(double[] ContractNum)

{

double sum2OfDiff=0.0;

double sum2OfContractNum=0.0;

double totalPayoff;

for (int i = 0; i < interpolatedStockPrice.Length; i++)

{

totalPayoff = 0.0;

for (int j = 0; j < options.Length; j++)

{

totalPayoff+= options[j].Payoff(interpolatedStockPrice[i]) * ContractNum[j];

sum2OfContractNum += Math.Pow(ContractNum[j]-Math.Round(ContractNum[j],0), 2); //Very important! To avoid trivial answers!!!

}

sum2OfDiff += Math.Pow(interpolatedTargetPayoffs[i] - totalPayoff, 2); //Residuals^2

}

return sum2OfDiff+sum2OfContractNum;

}

//Solver

internal double[] IndidualSolve()

{

var hls = new HybridLocalSearchSolver();

int[] contractNumID = new int[optionNum];

double[] results=new double[optionNum];

//Add variable in the solver

for (int i = 0; i < contractNumID.Length; i++)

{

hls.AddVariable(out contractNumID[i],

Microsoft.SolverFoundation.Common.Rational.NegativeInfinity,

Microsoft.SolverFoundation.Common.Rational.PositiveInfinity,

false);

}

//Solving

hls.AddGoal(hls.CreateNaryFunction(TargetFunction, contractNumID));//目标函数最小化

var hlsr = hls.Solve(new HybridLocalSearchParameters());

//Set results

for (int i = 0; i < results.Length; i++)

{

results[i] = hlsr.GetValue(contractNumID[i]);

}

return results;

}

}

public class OptionFunctions

{

//Function OptionPrice

[ExcelFunction(Description = "Exact solution for European option", Category = "Option Functions")]

public static double OptionPrice([ExcelArgument(Description = @"Call (""C"") or a put (""P"")")]string optionType,

[ExcelArgument(Description = @"Stock")]double underlying, [ExcelArgument(Description = @"Risk-free rate")]double interestRate,

[ExcelArgument(Description = @"Volatility")]double volatility, [ExcelArgument(Description = @"Strike price")]double strikePrice,

[ExcelArgument(Description = @"Time to maturity(in years)")]double timeToMaturity, [ExcelArgument(Description = @"Cost of carry")]double costOfCarry)

{

// Basic validation -

if (underlying <= 0.0 || volatility <= 0.0 || timeToMaturity <= 0.0 || strikePrice <= 0.0)

{

// Exception will be returned to Excel as #VALUE.

throw new ArgumentException();

}

Option o = new Option();

o.otyp = optionType;

o.r = interestRate;

o.sigma = volatility;

o.K = strikePrice;

o.T = timeToMaturity;

o.b = costOfCarry;

return o.Price(underlying);

}

//Function OptionPriceGreeks

[ExcelFunction(Description = "Compute exact solution for a European option, and returns price and greeks as a two-column, "

+ "six-row array with names and values", Category = "Option Functions")]

public static object[,] OptionPriceGreeks([ExcelArgument(Description = @"Call (""C"") or a put (""P"")")]string optionType,

[ExcelArgument(Description = @"Value of the underlying stock")]double underlying, [ExcelArgument(Description = @"Risk-free rate")]double interestRate,

[ExcelArgument(Description = @"Volatility")]double volatility, [ExcelArgument(Description = @"Strike price")]double strikePrice,

[ExcelArgument(Description = @"Time to maturity(years)")]double timeToMaturity, [ExcelArgument(Description = @"Cost of carry")]double costOfCarry)

{

// Basic validation

if (underlying <= 0.0 || volatility <= 0.0 || timeToMaturity <= 0.0 || strikePrice <= 0.0)

{

// Exception will be returned to Excel as #VALUE.

throw new ArgumentException();

}

Option o = new Option();

o.otyp = optionType;

o.r = interestRate;

o.sigma = volatility;

o.K = strikePrice;

o.T = timeToMaturity;

o.b = costOfCarry;

return new object[7, 2]{

{"Price", o.Price(underlying)},

{"Delta", o.Delta(underlying)},

{"Gamma", o.Gamma(underlying)},

{"Vega", o.Vega(underlying)},

{"Theta", o.Theta(underlying)},

{"Rho", o.Rho(underlying)},

{"Coc", o.Coc(underlying)}

};

}

//Function Payoff

[ExcelFunction(Description = "Payoff for European option", Category = "Option Functions")]

public static object[,] Payoff(

[ExcelArgument(Description = @"Call (""C"") or a put (""P"")")]object[] optionType,

[ExcelArgument(Description = @"Strike price")]object[] strikes)

{

int len=optionType.Length;

//Option and Stock Price at T array

<span style="white-space:pre"> </span> Option[] options;

double[] st;

double[] payoffs;

options= new Option[len];

st = new double[len + 2];

payoffs=new double[len+2];

//Initiate the first element st=0.0

st[0] = 0.0;

st[len + 1] = (double)strikes[len⑴]+10.0; //The last ST is last strike +10.0

for (int i = 0; i < len; i++)

<span style="white-space:pre"> </span> {

<span style="white-space:pre"> </span> options[i]=new Option();

options[i].otyp=(string)optionType[i];

options[i].K=(double)strikes[i];

st[i + 1] = (double)strikes[i]; //Set st as strike price

}

//Payoffs at different strockPrice

payoffs = COptionPayoff.OptionPayoff(st, options);

//Return result: St and corresponding Payoff

object[,] result;

result = new object[len+2,2];

for (int i = 0; i < len+2; i++)

<span style="white-space:pre"> </span> {

<span style="white-space:pre"> </span> result[i,0]=(double)st[i];

result[i,1]=(double)payoffs[i];

<span style="white-space:pre"> </span> }

return result;

}

//Return corresponding option contract number by minimizing square of sum of the payoff difference

//ST: 0, 100, 110, 120, 140, 150

//Payoff: 0, 10, 20, 20, 10, 10

[ExcelFunction(Description = "Return corresponding option contract number by minimizing square of sum of the payoff difference ", Category = "Option Functions")]

public static object[,] OpTypeStrikeContractNum(

[ExcelArgument(Description = @"Stock price at maturity")]object[] StockPrices,

[ExcelArgument(Description = @"Target payoffs")]object[] TargetPayoffs)

{

int obsNum = StockPrices.Length; //input number of stock price and target payoffs

int optionNumNeeded = 2*(obsNum - 2); //option number needed

int numAfterInterpolation = obsNum * 2 - 2;

double[] ContractNum; //1st col: Type; 2nd col: Strike; 3rd col: ContractNum

double[] interpolatedStockPrice;

double[] interpolatedTargetPayoffs;

Option[] options;

//Initiate the needed options

options = new Option[optionNumNeeded];

ContractNum = new double[optionNumNeeded];

interpolatedStockPrice = new double[numAfterInterpolation]; //10

interpolatedTargetPayoffs = new double[numAfterInterpolation]; //10

//Set options strike prices

for (int i = 0; i < obsNum⑵; i++) //0,1,2,3

{

//Set the Option Instances

options[i] = new Option();

options[i].otyp = "C";

options[i].K = (double)StockPrices[i + 1];

options[i + optionNumNeeded / 2] = new Option();

options[i + optionNumNeeded / 2].otyp = "P";

options[i + optionNumNeeded / 2].K = (double)StockPrices[i + 1];

//Set certain interpolated stock prices

interpolatedStockPrice[i*2]=(double)StockPrices[i]; //0,2,4,6

interpolatedTargetPayoffs[i*2]=(double)TargetPayoffs[i];

}

//Set the last two elements in the interpolation

interpolatedStockPrice[numAfterInterpolation - 2] = (double)StockPrices[obsNum - 2];

interpolatedStockPrice[numAfterInterpolation - 1] = (double)StockPrices[obsNum - 1];

interpolatedTargetPayoffs[numAfterInterpolation - 2] = (double)TargetPayoffs[obsNum - 2];

interpolatedTargetPayoffs[numAfterInterpolation - 1] = (double)TargetPayoffs[obsNum - 1];

//Interpolation

for (int i = 1; i < optionNumNeeded; i += 2)

{

interpolatedStockPrice[i] = 0.5 * (interpolatedStockPrice[i - 1] + interpolatedStockPrice[i + 1]);

interpolatedTargetPayoffs[i] = 0.5 * (interpolatedTargetPayoffs[i - 1] + interpolatedTargetPayoffs[i + 1]);

}

//Solver

CSolver solver = new CSolver(options, interpolatedTargetPayoffs, interpolatedStockPrice);

ContractNum = solver.IndidualSolve();

//result => 1st column is option type; 2nd column is strike; 3rd column is contract number

object[,] result = new object[optionNumNeeded,3];

for (int i = 0; i < optionNumNeeded; i++)

{

result[i, 0] = (string)options[i].otyp;

result[i, 1] = (double)options[i].K;

result[i,2] =(double) ContractNum[i];

}

return result;

}

}

}

例如,1个Strangle+Put:

------分隔线----------------------------

下一篇 vb学习笔记

------分隔线----------------------------